-40%

1/4 RESIDENTIAL LOT by Beach and Golf Club, PENSACOLA, Florida / Pre-Foreclosure

$ 52.8

- Description

- Size Guide

Description

New Page 1Read Entire Auction Before Bidding. Read TERMS and CONDITIONS.

Read Before Bid!

This is a

CASH SALE!

Not for Payments!

No Minimum! No Reserve! High Bid Wins This Auction!

County Delinquent Tax Sale

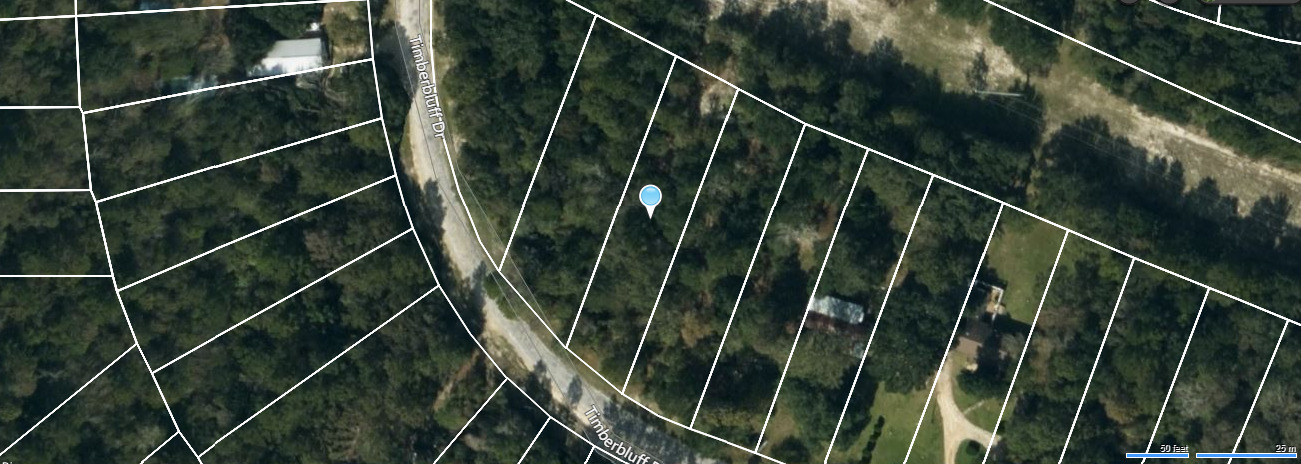

1/4 RESIDENTIAL LOT by Beach and Golf Club, PENSACOLA, Florida.

(see pics & county info for details)

Previously Sold in 1980 for ,500.00

The Lot is located by Perdido Bay Golf Club!

Nice Residential Buildable Lot in Great Location! The Lot is 80*130 sf. There are no any developments planned in the future between this lot and the beach! So, you are practically have a WATERFRONT property!!!

Walk to Shoreline - Tarklin Bay! Just few hundred feet from the beach!

Between Tarklin Oaks Estates and Perdido Bay Communities.

Street View from Omaha Dr. Beautiful tall pine trees on the lot.

Another Street View from Shoshone Dr. - a neighboring street - typical houses in the area!

Another Street View from Navaho Dr. - Perdido Golf Course community.

Another Street View on typical waterfront houses by the beach and the Golf Course.

Street View on the beach nearby.

Another Street View from Pale Moon Dr. - short walk from the lot!

Real Estate Prices Nearby, according to Zillow. Property the next street is for sale for 0,000.00 !!!

Perdido Bay Golf Course Offers a lot of activities!

Near Navy Point Triangle Park.

Pensacola Lighthouse and Museum is very close.

Lighthouse view.

Beautiful Beaches and Parks of Pensacola, Florida!

Welcome to Sunshine State!

Escambia County Florida Property Appraiser Parcel Information:

Property Address:

30.339482,-87.416013 or close to Omaha Dr, Pensacola, FL 32506

Tax Type

REAL ESTATE

Property Address

0 OMAHA DR

Exempt Amount

Taxable Value

See Below

See Below

Exemption Detail

Millage Code

Escrow Code

NO EXEMPTIONS

06

Legal Description (click for full description)

083S32-1200-024-002 0 OMAHA DR LOT 24 BLK 2 PERDIDO BAY COUNTRY CLUB ESTATES UNIT 5 PB 8 P 71 OR 1407 P 907

Ad Valorem Taxes

Taxing Authority

Rate

Assessed Value

Exemption Amount

Taxable Value

Taxes Levied

COUNTY

6.9755

1,069

0

,069

.46

PUBLIC SCHOOLS

By Local Board

2.2480

1,069

0

,069

.40

By State Law

5.5730

1,069

0

,069

.96

SHERIFF

0.6850

1,069

0

,069

{{detail_product_description}}.73

WATER MANAGEMENT

0.0400

1,069

0

,069

{{detail_product_description}}.04

Total Millage

15.5215

Total Taxes

.59

Non-Ad Valorem Assessments

Code

Levying Authority

Amount

NFP

FIRE (CALL 595-4960)

.00

Total Assessments

.00

Taxes & Assessments

.59

Owed Taxes

: $ 638.16 Due Upon Foreclosure

--

Have you ever wondered how some middle income investors are able to accumulate multi-million dollar real estate holdings?

Invest in County Delinquent Tax Sale!

A

well-kept Real Estate secret, how to make

MILLIONS for ONLY PENNIES ON A DOLLAR in REAL ESTATE business

!!!

Only Banks and a handful of Real Estate Investors use this technique to accumulate a large amount of wealth!

Acquire valuable real estate from the first hands! Skip all the middle men! Get Prime Real Estate straight from County with a low price tag!

Get Valuable Real Estate for only Pennies on a Dollar!

“Why do people call this the best way to acquire real estate for pennies on the dollar?

Here is a rough comparison of how different types of people buy real estate:

The

average Real Estate Buyer

using a real estate agent (with a low level of effort required) will typically

pay 110-150% of market value

.

The

skilled rehabber

(with a very high level of effort required) will typically

pay 75-80% of market value.

The sophisticated

foreclosure auction buyer

(with a low level of effort required) will typically

pay 60-85% of market value.

The sophisticated

tax deed auction buyer

(with a low level of effort required) will typically pay

10-65% of market value

.

The sophisticated

investor

in the

County Delinquent Tax Sales

(with a moderate level of effort required) will typically

pay 1-20% of market value!

”

You can multiply your Real Estate Portfolio just in

a few

years with only 200$-300$ of an initial investment!

Don’t let this chance, to

become a Millionaire

, to slip away!!!

Bid Now! Win Now! Buy Now! Get Rich Later!

You Will Be A 100% Satisfied With A Result!

BY

WINNING

THIS

AUCTION

YOU

WILL

HAVE

THE

RIGHT

TO

FORECLOSE

ON

THIS

PARCEL

AND

GET

A

MARKETABLE

DEED

DIRECTLY

THROUGH

THE

COUNTY

!!!

You will receive all the Transfer Paperwork in just 3-4 business days after your payment is received!

Please Do Not Hesitate To Ask Any Questions Prior Bidding!

We’ll be happy to answer them and guide you through the foreclosure process!

This is a County Delinquent Taxes Sale.

You bid on a lien (year 2018) that is secured by this parcel and may initiate the foreclosure process by applying a Tax Deed Application through the county at any time after 2 years have elapsed since April 1 of the year of the issuance of the lien and before the expiration of 7 years from the date of issuance in accordance with Florida Statute 197.502, Florida Statutes.

Grantee of Tax Deed entitled to immediate possession (Reference: Florida Statute 197.562)

Bid Early! The Seller reserves the right to close this listing at any time.

Serious Bidders Only! Non-Payment of Auction may result the Suspension of your eBay Account.

If You Have No or Low Feedback, Please contact me before bidding with a statement that you understand the auction item you’re bidding on and you place your bid accordingly.

Buyer is advised to do any and all due diligence before bidding.

PAYMENT:

The Transfer Documentation Fee of

5.00

will be added to your Final Bid Amount. The Total Payment is due within 4 business days.

The payment can be made by certified funds: Cashier's or Money Order Checks, Personal or Business checks.

The Document Transfer to Buyer from County takes about 2-4 weeks after payment clears.

TERMS and CONDITIONS:

Your bid is a binding contract to pay the amount of your bid if you are the winning bidder.

By bidding, you agree that you have:

a. Made ALL DUE DILIGENCE regarding the auction item and bidding accordingly; or

b. Waived your right(s) of doing your DUE DILIGENCE and are bidding at your own risk and on your own decision to do so;

c. Read and Agreed with current Terms and Conditions of this auction.

READ before you BID!

ASK ANY QUESTIONS NOW before you bid and buy!

We have listed all information accurately and to the best of our knowledge but you MUST do your OWN due diligence before you bid, NOT after the auction has closed.

IF you wait until AFTER you have won the auction to ask questions, we will NOT be responsible for your lack of due diligence!

All sales are final, no refunds will be given, unless the lien is redeemed during the transfer process. In this case, the seller reserves the rights to give a refund or substitute the item of similar value.

The 5.00 (non-refundable) documentation transfer fee will be added to the highest bid amount.

The auction starts at very low price, only 0! YOU set the winning bid amount in this auction.

The winning bidder MUST make a payment by certified funds as a Cashier's Check or Money Order(s), or Personal/Business Check. Payment due in four days after auction close.

If funds are not received within 4 days (unless you notify us to extend a payment due date), the winning bidder will be reported to eBay as a non-payer and/or have bidder’s eBay account being suspended and /or being responsible to pay any and/or all fees associated with posting this listing.

Please note that this auction is not a sale of the real property.

The winning bidder of this auction will receive a legal document, tax lien certificate, representing a first lien against the property

(

Florida Statutes 197.102 (3)

and

may

foreclose and gain title to the property

in accordance with The Florida Statutes 197.502

https://www.leg.state.fl.us/Statutes/index.cfm?App_mode=Display_Statute&Search_String=&URL=0100-0199/0197/Sections/0197.502.html

--

Thank You and Happy Bidding!

Please Take a Look At My Other Auctions!

--